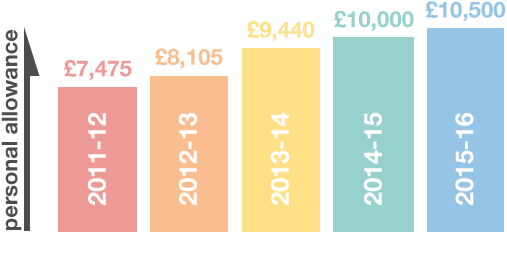

This year's Budget, set out last week by the Chancellor, backed makers, doers and savers. One of the Government's main announcements was a third consecutive rise in the Personal Allowance - essentially a tax cut for hardworking people in Swindon.

Rises in the Personal Allowance (the amount of salary retained by an employee, tax-free) since 2010 mean that by April next year a typical basic rate taxpayer will be paying £805 less in tax than they would have been.

From April 2015 the Personal Allowance will rise to £10,500. These changes will cut the taxes for 25 million people and take another 290,000 people out of paying income tax altogether. 3.2 million nationally people taken out of income tax altogether since 2010.

In North Swindon, the increase in the Personal Allowance to £10,500 will result in a tax cut for 43,478 and take 571 people out of tax altogether. Across Swindon 81,544 will benefit from a tax cut and 1,010 will no longer by any income tax at all.

Justin Tomlinson MP said: "This tax cut is excellent news for hardworking people in North Swindon. It will mean lower taxes for around 43,478 people here in North Swindon, with 571 people taken out of income tax altogether. That means 43,478 people keeping more of the money they’ve worked hard to earn, giving them and their families more financial security for the future".